SWIFT, short for the Society for Worldwide Interbank Financial Telecommunication, stands as the backbone of international finance, offering a standardized platform for financial institutions to securely exchange information and directives. Since its inception in 1973, SWIFT has transformed financial communication, linking over 11,000 institutions across 200 countries and territories.

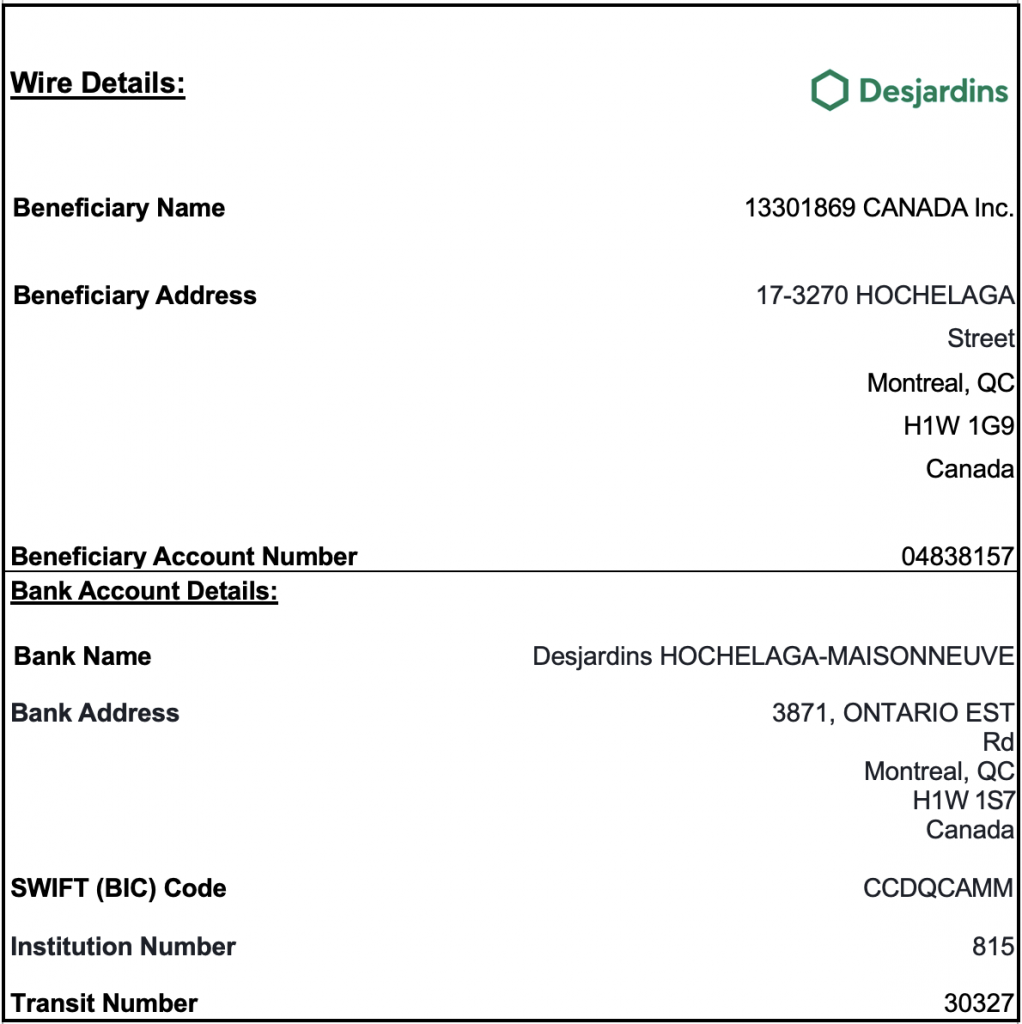

At its core, SWIFT employs a series of 8 or 11-character codes, known as SWIFT/BIC codes, to pinpoint a bank’s location and branch. These codes guarantee the accurate routing of cross-border transactions, ensuring funds reach their intended destination swiftly and securely.

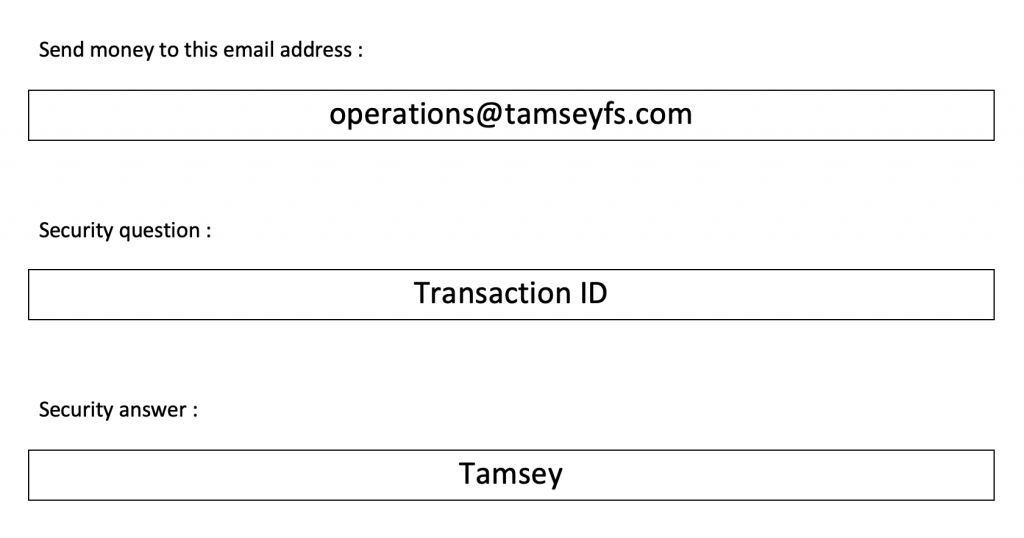

Contrary to popular belief, SWIFT doesn’t physically transfer money. Instead, it facilitates the transmission of payment orders between banks, with the actual settlement occurring through correspondent accounts held by participating institutions. Each transaction is tagged with a unique identifier, enabling seamless tracking and enhancing security measures.

Using SWIFT for international money transfers offers several advantages that have led to its widespread adoption by financial institutions worldwide. Here are some key benefits, explained in simpler terms:

- Global Reach: SWIFT links banks all around the world, making it easy and secure to transfer money between different countries.

- Speed: It helps money move quickly and efficiently, which is important for businesses and trade across the globe.

- Security: SWIFT keeps messages safe from unauthorized access or changes with strong security measures, ensuring that financial communication is protected.

- Accountability: The system makes it easy to track payments between banks, so both the sender and receiver know exactly when money is sent and received.

- Accessibility: In our interconnected world, sending money across borders can be complicated, but SWIFT simplifies this process, making it easy for banks to communicate with each other.

- Transparency: Users get clear information about the costs of transactions, helping them understand the fees associated with transferring money.

In essence, SWIFT plays an indispensable role in global banking, serving as a trusted conduit for transmitting vital information on financial transactions. Its contribution to international fund transfers is paramount, ensuring the seamless movement of funds across borders.