In our increasingly globalized world, sending money abroad has become a common necessity for many individuals and businesses alike. Whether you’re sending money to family members overseas, paying for international services, or conducting business transactions, navigating currency exchange rates is essential for maximizing the value of your money. However, understanding the complexities of exchange rates and knowing how to make the most of them can be daunting. In this guide, we’ll explore some tips and strategies to help you navigate currency exchange rates effectively and get the best value when sending money abroad.

Understand Exchange Rate Basics:

Before delving into strategies, it’s crucial to grasp the fundamentals of exchange rates. An exchange rate represents the value of one currency in terms of another. Exchange rates are influenced by various factors such as economic indicators, geopolitical events, and market sentiment. Exchange rates fluctuate constantly, so it’s essential to stay updated on current rates.

Compare Exchange Rates:

When sending money abroad, don’t settle for the first exchange rate you come across. Different banks, money transfer services, and currency exchange providers offer varying rates and fees. Take the time to compare rates from multiple sources to find the most favorable deal. Online platforms and currency converters can be valuable tools for comparing exchange rates quickly and easily.

Monitor Exchange Rate Trends:

Exchange rates are subject to fluctuations due to market dynamics. Monitoring exchange rate trends can help you make informed decisions about when to send money abroad. Look for patterns and keep an eye on economic news and events that could impact exchange rates. Timing your money transfers strategically based on favorable rate movements can result in significant savings.

Consider Transfer Fees and Hidden Charges:

While exchange rates are crucial, don’t overlook transfer fees and hidden charges. Some providers offer competitive exchange rates but compensate by charging high fees. Before finalizing a money transfer, inquire about all associated costs, including transaction fees, processing fees, and any additional charges. Opt for providers with transparent fee structures to avoid unexpected expenses.

Choose the Right Transfer Method:

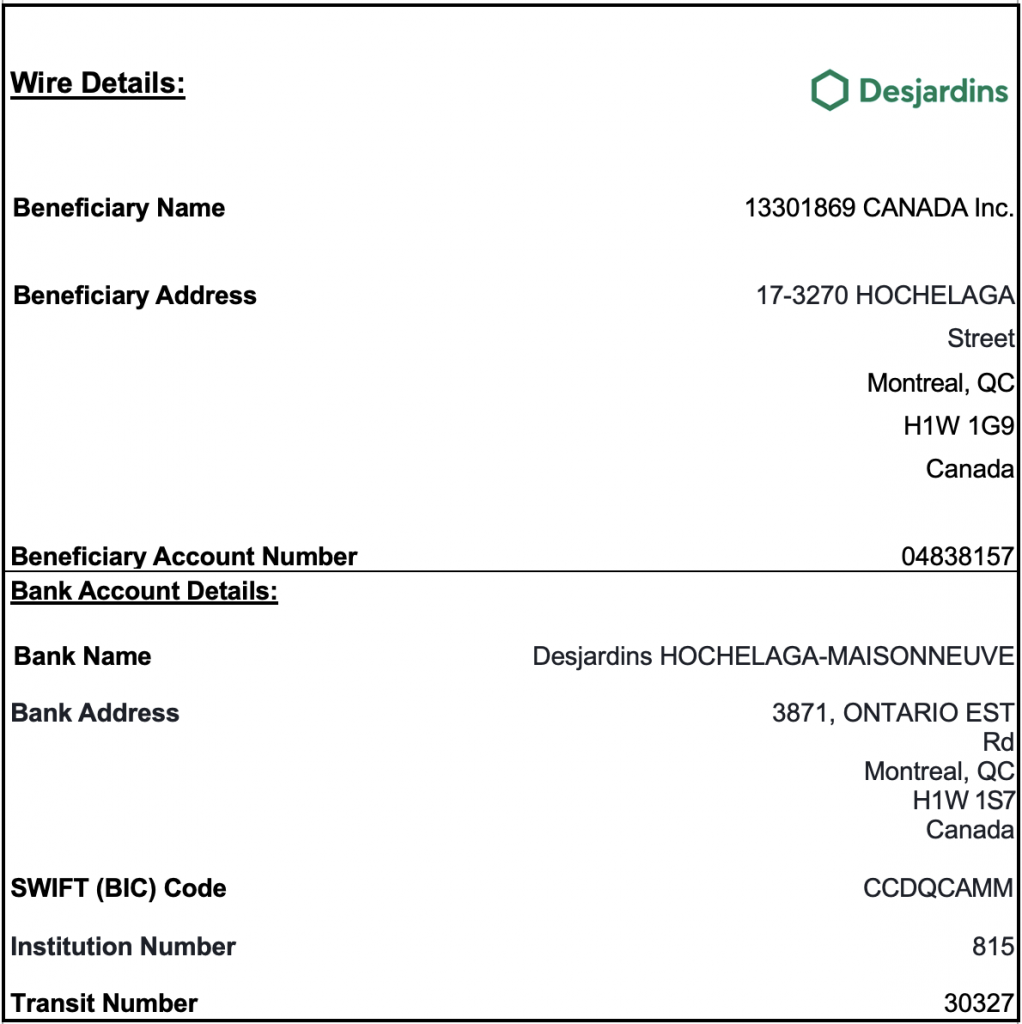

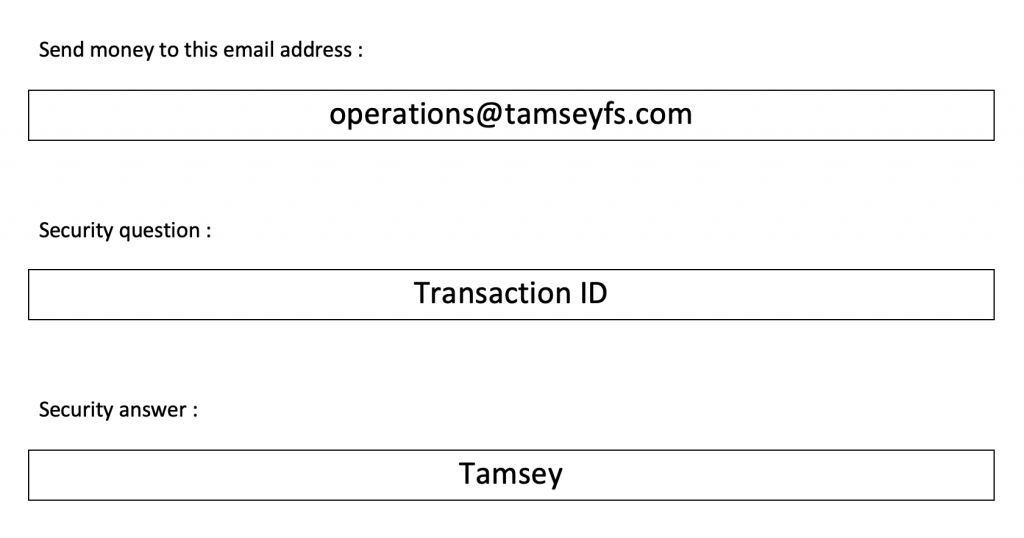

The method you use to send money abroad can also affect the overall cost and convenience of the transaction. Bank transfers, wire transfers, online money transfer services, and remittance companies are common options. Each method has its pros and cons in terms of speed, cost, and ease of use. Consider factors such as transfer speed, security, and availability when selecting the appropriate transfer method for your needs.

Utilize Forward Contracts and Limit Orders:

Forward contracts and limit orders are advanced strategies that can help you secure favorable exchange rates for future money transfers. A forward contract allows you to lock in an exchange rate today for a future transaction, shielding you from adverse rate movements. Similarly, a limit order enables you to set a target exchange rate, and your transfer will be executed automatically when the desired rate is reached. These tools provide flexibility and control over your currency exchanges, minimizing the impact of market volatility.

Explore Currency Hedging Options:

For businesses and individuals with significant currency exposure, hedging strategies can help mitigate risks associated with exchange rate fluctuations. Hedging involves using financial instruments such as options, futures, and forwards to protect against adverse currency movements. While hedging can be complex and may involve additional costs, it provides peace of mind and stability in uncertain market conditions.

Consider Peer-to-Peer Currency Exchange:

Peer-to-peer (P2P) currency exchange platforms connect individuals looking to exchange currencies directly, bypassing traditional financial institutions. P2P exchanges often offer competitive rates and lower fees compared to banks and money transfer services. Additionally, P2P platforms promote transparency and trust by allowing users to negotiate rates and verify counterparties’ identities. Explore reputable P2P currency exchange platforms as an alternative to traditional methods for sending money abroad.

In conclusion, navigating currency exchange rates requires careful consideration and informed decision-making. By understanding the basics of exchange rates, comparing rates from multiple sources, monitoring market trends, and utilizing advanced strategies and tools, you can maximize the value of your money when sending funds abroad. Whether you’re an individual sending money to loved ones overseas or a business conducting international transactions, these tips will help you optimize your currency exchanges and save on unnecessary costs. Stay informed, be proactive, and choose the right approach to make the most of your international money transfers.