In today’s digital world, money transfer apps have become an indispensable tool for anyone looking to send and receive funds seamlessly. With so many options available, it is hard to choose the right money transfer app.

Each app offers a unique set of features, and determining which one fits your needs can be overwhelming.

Luckily, you don’t have to navigate this decision alone. Whether you’re sending money to a friend, making international transfers, or paying bills, selecting the best app for your situation requires a thoughtful analysis of factors like security, fees, speed, and user experience.

This comprehensive guide will walk you through everything you need to know to make the right choice.

Security:

The Top Priority When you Choose the Right Money Transfer App

When it comes to financial transactions, security is non-negotiable. You want an app that protects your personal and financial information at all costs.

The best money transfer apps utilize encryption technologies like SSL (Secure Socket Layer) to protect data. Look for apps that also offer multi-factor authentication, which provides an extra layer of protection.

Another factor to consider is the app’s reputation. Trusted apps usually have positive user reviews and a clear privacy policy. Does the app comply with major regulatory standards? Apps operating in regulated markets tend to offer higher levels of protection and transparency.

Lastly, never forget to investigate whether the app has any security certifications or accreditations. Certifications like PCI DSS (Payment Card Industry Data Security Standard) ensure that the app follows strict security protocols to handle cardholder data.

Evaluating Fees:

Hidden Costs to Watch Out For when you choose the right money transfer app

Not all money transfer apps are created equal when it comes to fees. Some apps charge flat fees for transactions, while others take a percentage of the transferred amount. Depending on how often you transfer money and the amount you’re sending, these fees can add up over time.

Be sure to review the app’s fee structure carefully. Are there fees for domestic transfers? How much will you be charged for international money transfers? Some apps may also charge for currency conversion, which can be a hidden cost if you’re dealing with international transfers. It’s essential to factor in these costs when comparing your options.

Free or low-fee apps may sound appealing, but it’s crucial to weigh these against other factors like speed and security.

Transfer Speed:

How Fast Will Your Money Reach Its Destination?

Speed is often a deciding factor for many users when selecting a money transfer app. Some apps offer instant transfers, while others take a few business days to process transactions.

The speed of your transfer can depend on several factors, including the destination country, the method of transfer (bank transfer, credit card, or digital wallet), and the amount being sent.

If speed is critical—say you’re paying bills or sending money in an emergency—an app offering real-time or same-day transfers may be your best option. However, these quicker options may come with higher fees, so you’ll need to balance your need for speed with your budget.

User Experience:

Simplicity and Ease of Use

Nobody wants to waste time figuring out how to send a payment. A money transfer app should be easy to use, with a simple interface and smooth navigation. Look for apps that let you send money in just a few clicks or taps.

Check reviews to see if users find the app intuitive, especially in your demographic. Is it easy to navigate, even for less tech-savvy people? Extra features like contactless payments, recurring transfers, and reminders can further improve the user experience.

Supported Countries and Currencies:

A Global Consideration

Not all money transfer apps support international transactions, and even those that do may not handle all currencies. Before committing to an app, check whether it supports the countries and currencies you regularly send money to or receive from.

If you’re dealing with international transactions frequently, it’s worth investing time in finding an app that provides favorable exchange rates and lower currency conversion fees. Some apps even allow you to lock in a specific exchange rate when sending money overseas, helping you avoid the uncertainty of fluctuating currency values.

Additional Features: What Else Does the App Offer?

In addition to the essentials—security, fees, speed, and ease of use—some money transfer apps offer unique features that set them apart from the competition. For instance, certain apps allow users to schedule future transfers, send money directly from their bank account, or even invest in cryptocurrencies. Others offer cashback rewards or discounts for frequent users.

These extra features can be an added bonus, especially if you’re someone who regularly makes transfers or uses the app for multiple purposes. While they shouldn’t be the primary factor in your decision, they can certainly sweeten the deal.

Conclusion

While you Choose the right money transfer app it doesn’t have to be a complicated process. By focusing on key aspects such as security, fees, transfer speed, and user experience, you can quickly narrow down your options to find the app that fits your needs. Don’t forget to consider factors like international support and additional features, especially if you’re looking for more than just basic money transfers.

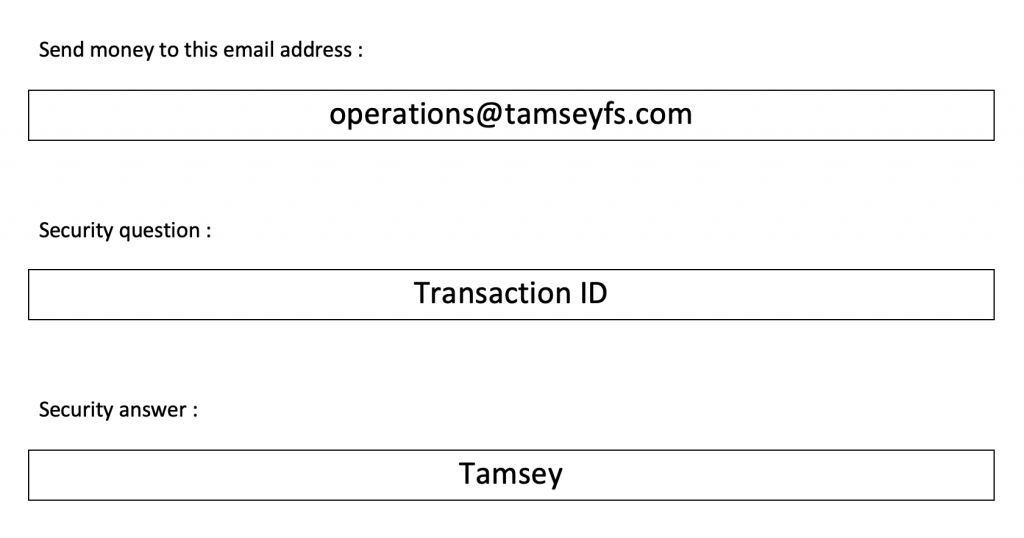

Download Tamsey to know more!