When traveling abroad, accessing your money safely and efficiently is essential for a stress-free trip. Gone are the days of relying solely on travelers’ checks or carrying large amounts of cash. Today, with the help of money transfer apps for travel, you can easily manage your finances and have access to your funds wherever your journey takes you. These apps allow you to send money, withdraw cash, and even pay for services without the hassle of traditional banking methods. However, navigating foreign ATMs, currency exchanges, and transfer fees can still pose challenges. This guide will provide you with practical tips on how to use money transfer apps for travel, minimize fees, and maximize convenience, ensuring a smooth and cost-effective experience abroad.

Why Use Money Transfer Apps for Travel?

Money transfer apps for Travel are a convenient way to move funds between accounts, pay for services, or send money to others while you’re abroad. These apps allow you to access your bank account, transfer funds to local accounts, and even make international payments in different currencies, often with lower fees than traditional banks.

Using these apps while traveling offers several benefits:

- Convenience: You can access funds quickly without needing to visit a bank or currency exchange.

- Lower Fees: Many apps offer better exchange rates and lower fees compared to traditional methods like credit cards or ATMs.

- Security: With robust encryption and authentication features, money transfer apps provide a safer way to manage your travel finances.

Choosing the Right Money Transfer Apps For Travel

Not all Money transfer apps for Travel are created equal. Some specialize in low-fee international transfers, while others excel in speed or security. To find the right app for your travel needs, consider the following factors:

- Global Coverage: Ensure the app works in your destination country and offers support for the local currency.

- Exchange Rates: Look for apps with competitive exchange rates to avoid losing money during currency conversion.

- Fees: Compare transaction and withdrawal fees. Some apps charge minimal fees, while others can be costly.

- Security Features: Choose an app with strong encryption and two-factor authentication to protect your account from fraud.

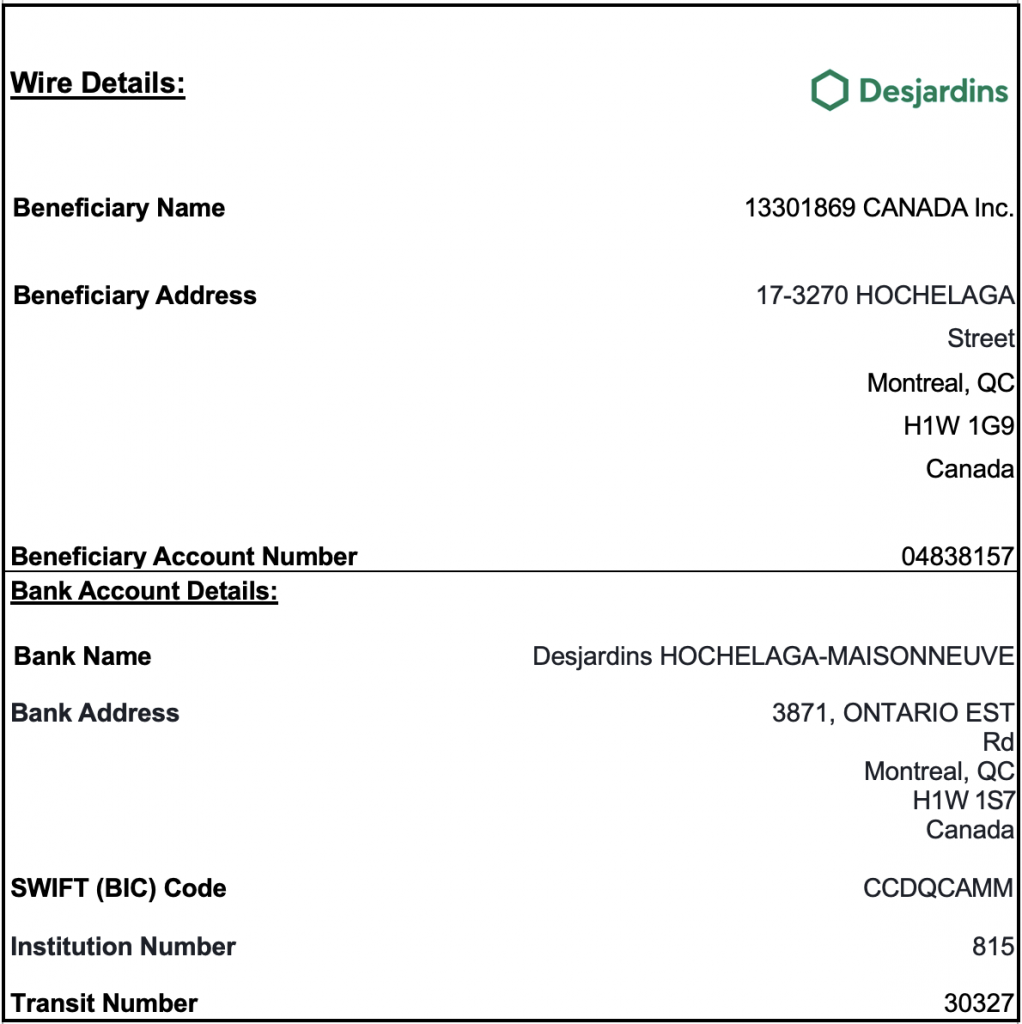

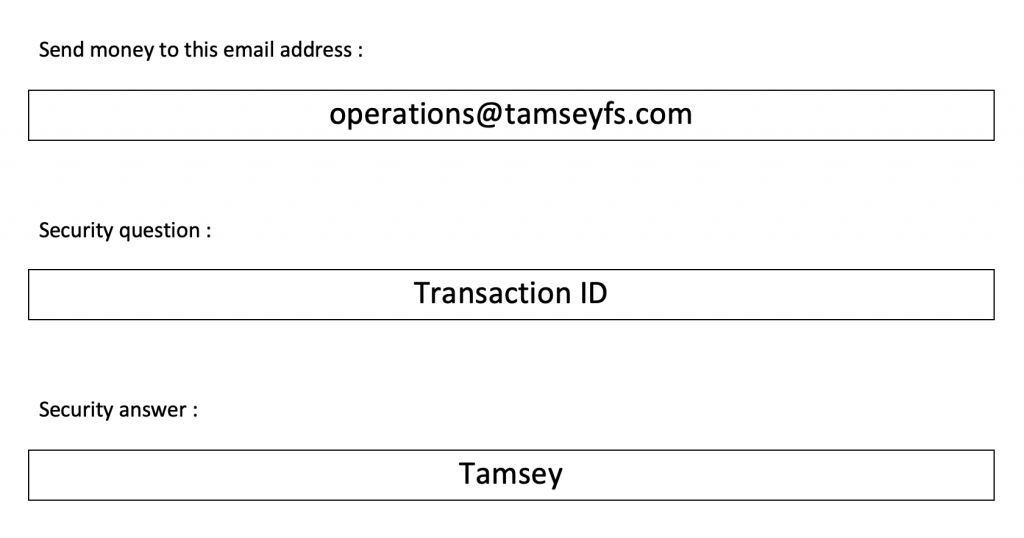

For Example – Tamsey

Accessing Funds Safely Abroad

Once you’ve chosen your money transfer app, here are some key strategies for accessing funds safely and avoiding high fees:

1. Avoid High ATM Fees

Foreign ATMs can charge hefty withdrawal fees, in addition to fees from your home bank. To minimize these charges:

- Use Local Bank ATMs: Some local banks partner with international institutions to offer lower fees or fee-free withdrawals for travelers.

- Check Your Bank’s Policies: Many banks offer refunds for ATM fees abroad, especially if you use certain networks like Global ATM Alliance.

- Withdraw Larger Amounts: To avoid multiple transaction fees, withdraw a larger sum of money at once rather than frequent small withdrawals.

2. Transfer Money to Local Accounts

If you’re staying in a country for an extended period or need to pay local vendors, transferring money to a local bank account can be more cost-effective. Many money transfer apps allow you to:

- Send Money Directly to Local Banks: Services like Tamsey enable you to send money directly to local accounts, often with lower fees and better exchange rates than traditional banks.

- Receive Payments Locally: If you’re working or freelancing abroad, you can receive payments directly through these apps and avoid the hassle of converting currencies.

3. Use Multi-Currency Accounts

Some money transfer services offer multi-currency accounts that allow you to hold multiple currencies in a single account. This can help you:

- Avoid Conversion Fees: By holding foreign currencies, you avoid frequent conversions when spending in that currency.

- Lock in Exchange Rates: Some apps let you convert currencies when rates are favorable and hold them until you’re ready to spend or transfer.

4. Pay with Apps Directly

In many countries, digital payments are widely accepted, and you can use money transfer apps to pay for goods and services directly, skipping the need for cash or cards altogether. Apps like Tamsey are widely used across the globe.

Security Tips for Managing Money While Traveling

While money transfer apps are generally safe, there are a few security measures you should take to protect your finances while abroad:

- Enable Two-Factor Authentication: This adds an extra layer of security to your account, ensuring that even if someone gets hold of your password, they can’t access your account without a second verification step.

- Use a VPN: When accessing banking apps or money transfer services on public Wi-Fi, use a VPN (Virtual Private Network) to protect your data from hackers.

- Monitor Your Accounts: Regularly check your transaction history to spot any unauthorized transactions. Most apps will notify you of unusual activity or ask for confirmation for large transfers.

Conclusion

Managing your money while traveling doesn’t have to be a hassle. By using the right money transfer apps for travel and being mindful of fees, you can access your funds safely and conveniently, all while avoiding the pitfalls of high ATM fees and unfavorable exchange rates. As digital payments become more prevalent worldwide, these apps are becoming an essential tool for modern travelers looking to manage their finances efficiently.